A 30-year high in the annual rate of inflation is hitting Canada’s lowest-income families hardest, experts say, as price hikes compound on groceries, essentials and other critical areas for those already struggling to make ends meet.

The consumer price index rose 4.8 per cent in the final month of 2021, the highest rate of increase since 1991, Statistics Canada said last week.

While the agency flagged a slight easing in gas price inflation amid Omicron-related lockdowns at the end of the year, costs were nonetheless up across the board on groceries, housing and passenger vehicles.

Those pain points are hitting residents like Ottawa’s John and Susan Redins particularly hard, as inflation outpaces income they rely on from the Ontario Disability Support Program (ODSP).

The Redins have been receiving ODSP for more than a decade ever since the car dealership John worked for went bankrupt and he suffered a double-hip collapse in 2010.

The pair gets roughly $800 covered for their rent but receives less than the standard $1,168 monthly check from ODSP because Susan isn’t considered to have a disability, reducing their overall family payouts.

But she’s meanwhile been locked in a two-and-a-half-year court battle to get ODSP to recognize her limitations as well, after her eyes were damaged in a car accident and she had a stroke in the middle of the night during the pandemic.

While she expects a resolution to her case in the months ahead, the end result is the Redins are being supported as a single person with a disability, when in practice they are two.

Trips to the community grocery store are now doubly painful for Susan: not only does she struggle to walk, needing a cane and having to take regular breaks on the route, but inflationary pressures are stretching the Redins’ already scant food budget to its limits.

“After the bills and rent is paid, we’re lucky if we have $50 a month for food,” Susan says.

“And now with the prices going up, it’s even less. So something has to give,” says John.

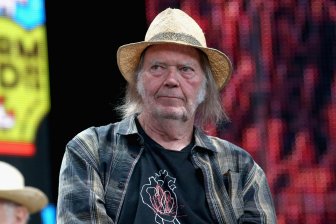

John (left) and Susan Redins say their disability supports from Ontario have not kept pace with surging inflation.

Provided

Wages, supports not keeping pace with inflation

Tu Nguyen, an economist with accounting firm RSM Canada, tells Global News that surging inflation hits low-income families like the Redins harder because it’s increasingly affecting Canadians’ pocketbooks in areas they can’t cut back.

“We have seen throughout the past two years living with the pandemic that food, as well as utility and fuel prices, have gone up by way more than other items and lower-income households spend a disproportionate portion of their income on groceries,” Nguyen says.

She notes that low-income Canadians often aren’t able to work remotely, and therefore can’t avoid paying more on gas, and their wages are less likely to keep pace with inflation.

For the Redins, subsisting on ODSP, there has been an outright freeze on the level of support they’ve received during the pandemic.

The last time ODSP rates increased was the first year the Progressive Conservatives came into office, when rates rose 1.5 per cent — a cut from the planned three per cent hike from the outgoing Liberal Party.

Global News reached out to the Ontario Ministry of Children, Community and Social Services for comment on why ODSP rates have not increased at all during the pandemic.

In an email, a spokesperson for Minister Merrilee Fullerton pointed to more than $1 billion in spending through the Social Services Relief Fund — a pandemic initiative to support shelters, food banks and other non-profits — as a measure of support for the province’s “most vulnerable.”

The spokesperson said that the ministry is working with its federal counterparts and flagged a 2021 campaign promise from the federal Liberals that called for the creation of the Canada Disability Benefit.

Global News reached out to the federal ministries of Finance and of Employment, Workforce Development and Disability Inclusion for comment on the proposed benefit’s rollout, but did not hear back before publishing.

“The thing I feel is that we’re being forgotten all through this pandemic,” says John Redins.

Grocery store and debt relief strategies

It’s harder for low-income Canadians to find places to cut down on costs, says personal finance expert Rubina Ahmed-Haq, because so many of these families and individuals are already using traditional money-saving strategies like cooking from home, reducing food waste and taking advantage of sales.

Susan Redins says she’s been baking her way through the pandemic, but even low-cost staples are starting to see price inflation.

“We very seldom buy bread, I make it. Muffins, I make it,” she says. “I think last winter, I went through eight 10-kilogram bags of flour.”

Still, there are a few dos and do nots that Ahmed-Haq recommends for Canadians trying to stretch their dollars as far as they can.

She recommends Canadians pick the most economical supermarkets to trim their grocery bills, and if possible, only shop a single day per week, as “extra costs” tend to sneak their way onto the receipt each time you visit the store.

Meat products have been subject to some of the highest inflation rates in Canada, so Ahmed-Haq recommends families on a budget embrace vegetarian meals as much as possible.

She also recommends downloading food saver apps, which flag discounts on baked or other fresh goods that have been priced down for quick sales.

“This is in addition to apps that you may be using to price match and do other things to save money,” she says.

One of the routes she recommends low-income families avoid is a pay-day loan service.

Instead, seek low-interest loans from your bank if you must take on short-term debt, she suggests. Property owners can also take out an affordable line of credit on their homes.

While families struggling to make ends meet might not benefit right now from paying a financial adviser for advice on investments, there are a number of debt and insolvency counsellors that provide education for Canadians in need at no cost.

“If you are looking for debt relief, there are a lot of free options,” she says.

© 2022 Global News, a division of Corus Entertainment Inc.

More Stories

Tesla’s Q1 net income down 55% year over year | CBC News

Elon Musk’s X, Australia government clash over order to take down church stabbing video | CBC News

Federal labour minister announces inquiry into 2023 B.C. port strike | CBC News